The State Of Responsibility 2023: Supplier Benchmarking

Over the spring and summer of 2023, PPAI Media asked industry suppliers of all sizes a series of questions to assess their status on a number of CSR fronts.

The following survey questions, which were also used to score the inaugural PPAI 100's Responsibility category, reveal how suppliers at multiple competitive bands in the marketplace compare to one another.

Suppliers: How does your firm stack up to the competition, and are there areas you can improve or update?

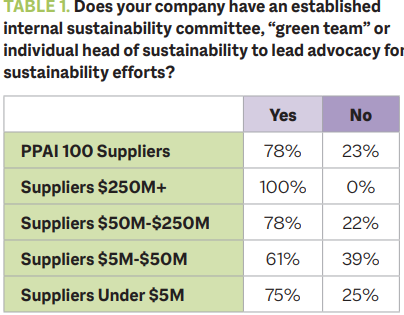

As the industry tries to scrub off its “brandfill” reputation, it’s reassuring that more than half of suppliers of all sizes have designated a position or committee to leading advocacy for sustainability efforts.

“It should be no surprise that the larger suppliers have programs in place for sustainability, reusable energy and charitable cause marketing,” says Brad Bartlett, president and owner of Dallas-based Opti Print & Fulfillment. “There’s been a big push the last few years, and these results are duly noted.”

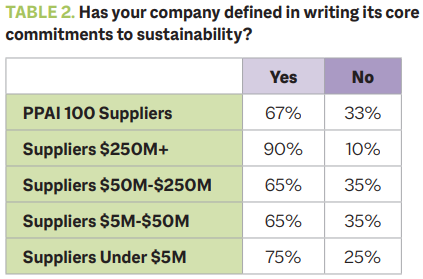

Dan Taylor, president and CEO of Virginia-based BamBams – ranked the No. 35 supplier in this year’s PPAI 100 – didn’t find the survey results to be terribly surprising.

“The CSR subject is challenging, and defining it is very subjective,” Taylor says. “The pressure to meet and measure a predetermined list of criteria or values imposed on our company by others (that may or may not share the same perspective) was difficult, but certainly made me consider some new objectives for the future.”

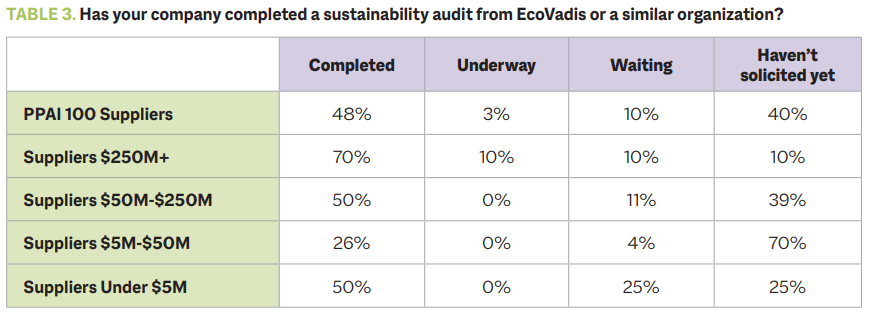

Minnesota-based Ball Pro – ranked the No. 37 supplier in this year’s PPAI 100 – hasn’t undergone a sustainability audit yet, but Adam Hanson, president of the golf product specialist, says he’s looking into it.

“We feel at this time it doesn’t make sense to do as a company because it opens you up to other areas,” Hanson says. “But it’s definitely something that will happen more over time.”

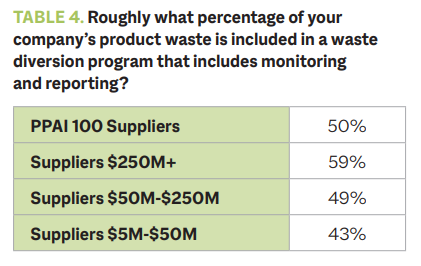

It’s not surprising that access to investment resources allows promo’s larger companies to create programs for monitoring and reporting product waste, which is vital for ensuring a positive environmental impact. A statistically insignificant portion of suppliers under $5 million reported answers to this question.

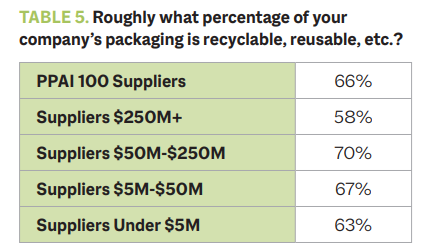

Sustainable packaging is beneficial, safe and healthy for communities throughout its lifecycle, which is why the majority of suppliers have transitioned to using packaging that consists of recyclable and reusable materials.

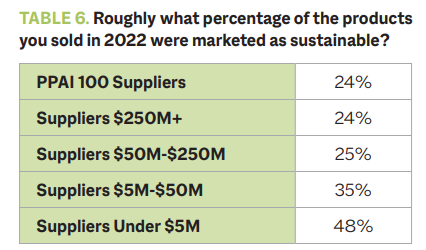

Silvia Pallaro, country manager for North America at New York City-based Atlantis Headwear, argues that it’s still not common to find companies in the U.S. promo industry that are fully committed to sustainability.

The industry average “appears to be around 25%-28% here, which I believe isn’t totally representative and is slightly too high,” Pallaro says. She also notes that it’s interesting to see smaller suppliers with a seemingly higher percentage of their offering marketed on sustainability grounds. “While the market is still far from being very sensitive to sustainability, this data demonstrates that sustainability is likely a focus of newer and younger companies and is likely to grow more and more in the future.”

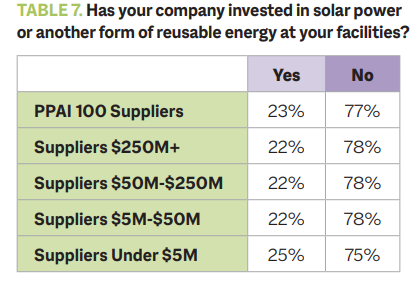

Based on the survey results, there’s plenty of room for improvement when it comes to suppliers investing in reusable energy at their facilities.

After all, the investment is certainly worth it. For example, solar power is a renewable and infinite source of energy that’s an easy and efficient way to offset carbon emissions. Furthermore, its processes don’t emit pollutants, so it doesn’t contribute to climate change the way burning fossil fuels does.

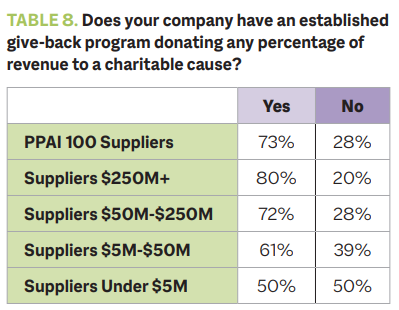

Although Ball Pro doesn’t have an established give-back program, Hanson says the supplier participates in other charitable efforts, such as partnering with nonprofit Feed My Starving Children to pack food for malnourished kids in nearly 70 countries. Even better, Hanson says Ball Pro employees get paid while volunteering with the organization.

“Giving back to your community is always a great thing to do,” he adds.

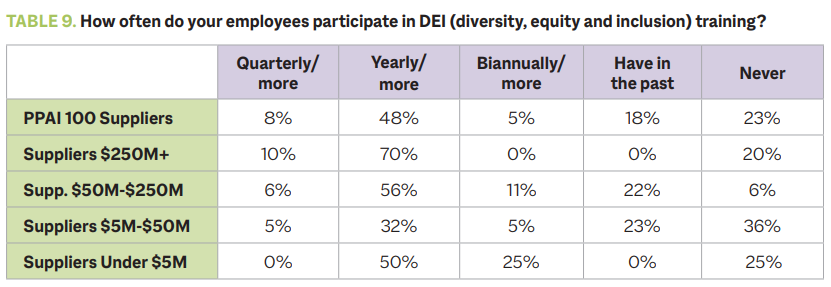

Aside from suppliers with revenue between $5 million and $50 million, the majority of suppliers in each category require their employees to participate in DEI training at least once a year. That might not be enough, according to Bartlett.

“This is one of the lowest categories as far as participation goes,” he says, “which I believe is because suppliers simply don’t know where to find these services, especially a cost-effective solution.”

The PPAI Diversity, Equity and Inclusion Playbook is available for download at ppai.org/advocacy/diversity-inclusion.

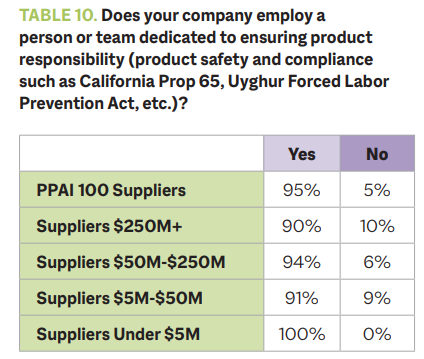

No surprise that this table had the highest percentage of “yes” responses from every supplier category in the report. Product safety and compliance is of the utmost importance, and suppliers clearly understand that designating a person or team to focus on product responsibility is simply a part of doing business in 2023.

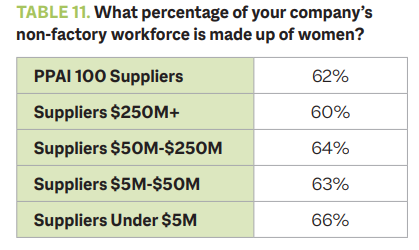

As Josh Ellis, publisher and editor-in-chief of PPAI Media opined in September, “promo’s future is female.”

Women outnumbered men 3 to 1 in the 2023 PPAI Rising Stars, the latest in a three-year trend of women occupying more spots on the list than their male counterparts. Perhaps most striking of all, 130 of the contest’s record 170 industry nominees this year were women. As evident by the data, promo firms are making a concerted effort to add and recognize more women in our traditionally male-dominated industry.

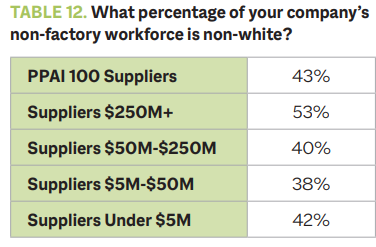

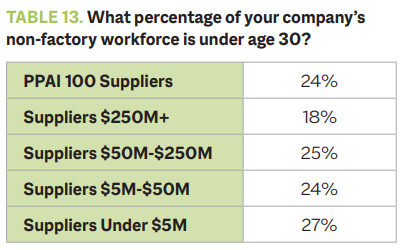

Although the overall industry has made great strides, diversifying the non-factory workforce remains a challenge for suppliers. Of course, it’s a journey worth taking, as bringing a wide array of perspectives into your company can yield great results in terms of CSR, inclusion and profitability.

“I believe PPAI could provide leadership in attracting younger participants to our industry,” Bartlett says. “We need to somehow show how our industry is a great place for young, qualified and educated candidates. This isn’t just an industry that people fall back on, it needs to be an industry that young talent wants to be a part of from the start.”