PPAI Research: A Turnaround For Promo's Small Businesses

Preliminary results have been tallied for PPAI’s Sales Volume Estimate, an annual survey of the industry collected by third-party research firm Relevant Insights on behalf of the Association.

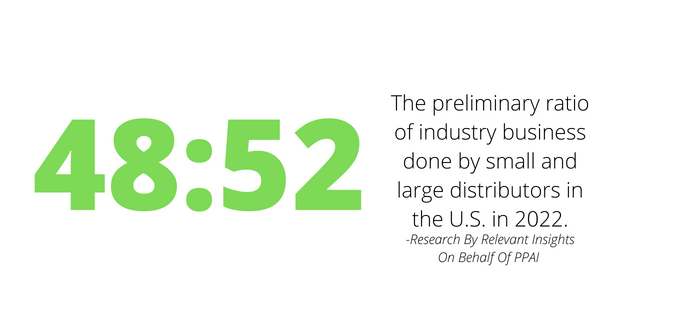

The survey remains open to distributors through the end of January, and while there is still wiggle room for results to shift, more than a few important trends from 2022 are worthy of highlight. Perhaps most interesting is the apparent rebound of the industry’s smaller distributorships.

Early results show that last year, smaller firms won back much of the business share that had been lost during the pandemic, nearly leveling the playing field with their larger counterparts and turning the industry back toward what it resembled in 2019.

The Early Findings

Perhaps the most glaring number in the sales volume survey is the largest one.

- Over $25 billion: The current estimate of the size of the U.S. promotional products market in 2022, a healthy increase of more than 13% over 2021.

While that number proves it was an excellent year for promotional products, the survey’s preliminary details also suggest that the industry has small businesses to thank for much of that success.

- More than $12 billion of that market is made up of what the survey considers to be small companies – those reporting less than $2.5 million in annual revenue.

- The early findings of the survey, therefore, indicate that small companies make up some 48% of the total market of promotional products, almost exactly the same share as 2019.

- Smaller companies appear to have grown at a much faster rate than their larger counterparts in 2022, logging upward of $3 billion or 30% gains over 2021, a year which was heavily affected by the pandemic.

The healthy balance between the market size of small and large companies is a welcome sign, especially after the years immediately following 2020 showed trends of small companies potentially being left behind as large companies survived economic and global factors.

The healthy balance between the market size of small and large companies is a welcome sign, especially after the years immediately following 2020 showed trends of small companies potentially being left behind as large companies survived economic and global factors.

“It is great to see growth in the industry impacting both small and large firms,” PPAI President and CEO Dale Denham, MAS+, says. “It is healthy for the industry to have firms of all sizes doing well and serving the needs of organizations.”

Denham took note of some of the survey’s biggest findings during his “state of the industry” opening remarks during The PPAI Expo 2023 last week.

Recent Historical Context

The preliminary report of over $25 billion in industry sales means that the promotional products business is doing more than just rebounding. It’s growing.

In terms of specifics, the growth of small companies’ percentage of the market is a surprising, if welcome, suggested finding.

- If the findings hold, small companies’ share of the industry would have increased more than 5% over 2021.

Signs For The Future

PPAI’s Sales Volume Estimate survey is sent to ranking personnel at distributorships. If you have received the survey but believe it is better intended for someone else within your company, or you have missed the survey and would like to request it, please contact surveys@relevantinsights.com.

The positive early numbers of the sales volume estimate are bolstered by the enthusiasm and optimism that was on display at The PPAI Expo 2023, as well as backed up by further PPAI Research on distributors’ rosy outlook for 2023.

- A distributor sales outlook conducted by PPAI Media found that 93% of surveyed promotional products distributors expect their sales this year to increase or remain the same as 2022.

- Nearly a third of the group expecting their businesses to grow predict that it will do so by a rate of 20% or more.

When Denham took the stage at The PPAI Expo 2023, he did so with a sense of optimism. The early numbers of the sales volume estimate are trending towards validating that optimism.

“I am proud of what our industry contributes to the marketing mix, and I am really excited for our future,” Denham said last week. “This is going to be a great year.”