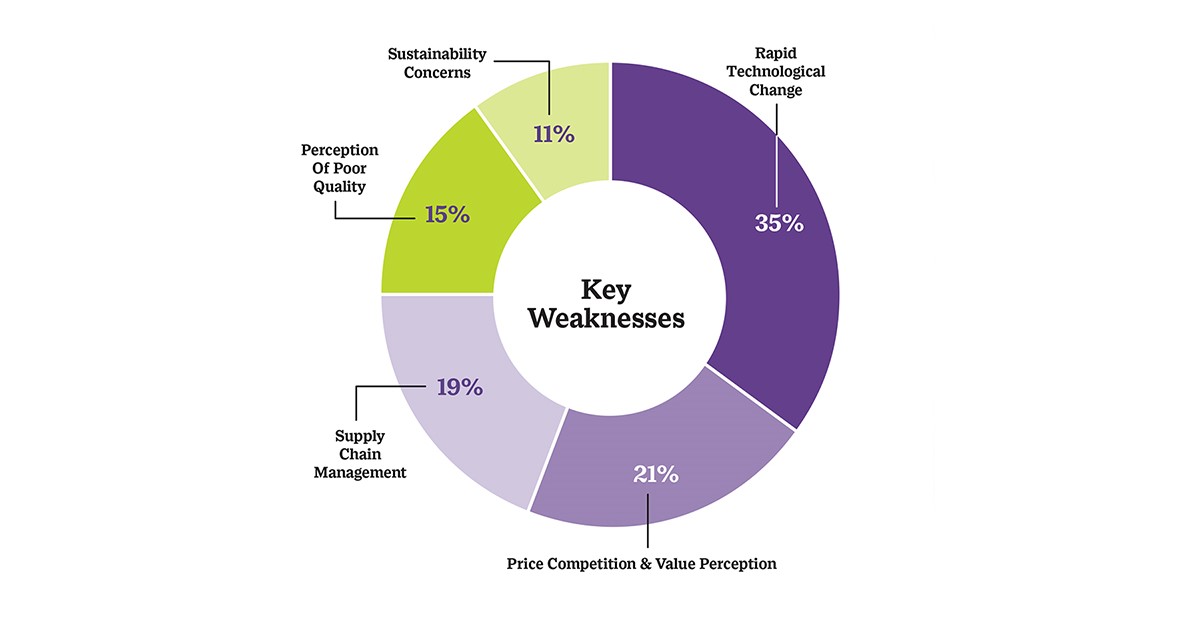

Outlook 2024: Identifying The Industry’s Weaknesses

Editor's Note: In a survey of distributors and suppliers in the fall, PPAI Research sought their perspectives on the present and future of the promotional products industry. PPAI Research used this data to produce a SWOT – strengths, weaknesses, opportunities and threats – analysis of the industry to get a better idea of where it's heading in the next three to five years.

In Outlook 2024, promotional products professionals have identified several pivotal limitations of the industry that can prevent further growth.

While some of these weaknesses have plagued the promo market for decades, others have become more visible in recent years. By addressing these areas for improvement within their businesses, promo firms can work toward solutions that will benefit not only themselves, but the overall industry.

Here are the weaknesses most commonly outlined by both distributors and suppliers:

35% | Rapid Technological Change

Both suppliers and distributors agree that embracing technological innovations like AI is necessary to stay competitive in the digital era.

“Technological improvement will help some of the industry’s shortcomings,” says a distributor.

“Adoption of technology, especially generative AI, is happening at a very fast pace, and younger generations are more in tune with it,” a supplier adds.

However, one-third of PPAI 100 suppliers and 22% of PPAI 100 distributors have experienced no significant impact after implementing AI, according to PPAI Research. The majority of respondents (63% of PPAI 100 distributors and 60% of PPAI 100 suppliers) report a lack of AI expertise as their most significant barrier.

Meanwhile, PPAI President and CEO Dale Denham, MAS+, claims that AI is overhyped. “While there will be some winners who figure out how to use AI sooner than others, it’ll be a distraction for most players if they spend too much time or energy on it,” he says. “Tech is important, but adopt the tech that’s proven before you chase the next big thing.”

21% | Price Competition & Value Perception

Intense price competition, especially from online retailers and direct-to-consumer sales, can erode margins and devalue the perceived worth of promo products. It’s vital that promo firms avoid the race to the bottom, maintaining pricing befitting of their quality service.

“We need to shift the conversation from price to value,” Denham says. “We create more value with our medium than any other form of advertising.”

19% | Supply Chain Management

The pandemic exposed how inefficient supply chains and reliance on overseas production can lead to delays and increased costs for all members of the promo industry.

“COVID has highlighted our heavy reliance on importing promotional products from other countries, particularly China,” a responding distributor says.

“Distributors and, most likely, end users will eventually shift everything overseas, cutting out the entire U.S. industry,” adds a responding supplier. “PPAI should continue to protect the domestic supply chain as much as possible.”

Although many firms have established alternative sourcing methods to diversify their supply chain, there have been other issues this year that posed potential logistical nightmares:

- More than 340,000 UPS workers were ready to go on strike if the shipping giant hadn’t come to terms on “the most lucrative agreement” with the International Brotherhood of Teamsters over the summer.

- West Coast ports are receiving uninterrupted U.S. imports from Asia again after the International Longshore and Warehouse Union reached an agreement with the Pacific Maritime Association, which represents port operators.

- Plus, the Panama Canal continues to face restrictions as an ongoing drought has reduced the waterway’s utility and threatens to cause greater problems if weather conditions don’t change. As a result, vessel capacity on all-water shipments from Asia to the East Coast has been reduced – some as much as 40% – in order to avoid hitting the bottom with water levels so low.

15% | Perception Of Poor Quality

Tying into price competition is “the negative perception that promotional products are unnecessary, brandfill and a waste of money,” according to one distributor.

The only way to combat that perception, another distributor argues, is to “get rid of ‘cheap’ promo,” such as items with a short shelf life and no real purpose. The industry must rally together to educate the public on what exactly promo firms provide: creative branding solutions, not low-quality giveaways, trinkets and tchotchkes.

“As a younger consumer, I appreciate items from companies that have meaning and are useful for the long term,” a responding supplier says. “Otherwise, it’s going to stay in a drawer for a few months until I do my next seasonal cleaning. The $1 item is no longer appreciated. Everyone can get one of those in whatever print they want online, so why would they want it with your company’s logo?”

The same supplier adds, “I appreciate the need for companies to market their brand, but the cheap items turn me off to a brand. I’d rather see them do a digital marketing push and skip the ‘junk’ promo just to get their name out there.”

11% | Sustainability Concerns

If the promo industry wants to erase its “brandfill” reputation, more suppliers and distributors must prioritize sustainability. After all, consumers are increasingly demanding eco-friendly products to lessen their environmental impact. Plus, weaknesses in areas like sustainability could intensify threats from increased regulation and changing consumer preferences.

“It would be great if suppliers would highlight their sustainability efforts on the homepage of their website,” a responding distributor says.

Roughly 31% of the products suppliers sold in 2022 and nearly a quarter (24%) of the products that distributors sold in 2022 were marketed as sustainable, according to The State of Responsibility 2023.

PPAI is taking sustainability seriously. This year, the Association hired industry veteran Elizabeth Wimbush as its first-ever director of sustainability and responsibility.

“An educated distributor sales force that pushes suppliers for what their end users increasingly ask for – sustainable options for product and a more transparent journey for those products into their hands – will be part of the push forward for our industry,” Wimbush says.