Indicators Suggest The U.S. Is Easing Into A Mild Recession: Promo Perspective

The economy has so far resisted expectations of a recession, but that may be coming to an end. Data from The Conference Board suggests we may be due for one later in first quarter 2023 and into second quarter, although it will likely be short and shallow.

The Outlook

PPAI Media recently joined a brief hosted by The Conference Board – an economic and business management research firm and publisher of several widely tracked economic indicators – on the U.S. economic outlook. It sought to answer questions around whether the U.S. was in a recession, what it might look like and what are some of the key risks facing the economy.

Leading economic indicators tracked by The Conference Board – business cycle indicators that use composite data points to track economic expansions, recessions and recoveries – have fallen well into negative territory, pointing to recession in the U.S. economy starting sometime in first quarter 2023 or early second quarter.

The Conference Board analysis points to a relatively mild and short-lived recession, with its deepest point coming in second quarter 2023.

Of course, with a potential debt ceiling fight looming in Congress, all of this could go out the window.

“The debt ceiling debate is the most front and center issue that could disrupt the entire apple cart and take us off the path,” says Dr. Lori Esposito Murray, president of the Committee for Economic Development, the public policy center of The Conference Board. “A lesson from 2011 is that even the debate is disruptive. The downgrading of the U.S. credit rating was because of the debate, not the cliff.

It’s very easy to have the crisis and hit the cliff. It’s harder to recover from it.”

Promo Perspective

The promotional products industry is as susceptible to the ebb and flow of the economy as any other business sector. It was hit hard by the Great Recession in 2008; registering $19.4 billion in sales in 2007 and bottoming out at $15.6 billion in 2009. It took the industry six years to fully regain lost ground.

The industry entered 2023 in a healthy position, with PPAI's 2022 Distributor Sales Volume Estimate showing sales of $25.5 billion, a record high.

Industry leaders cited several factors behind the industry's strong 2022, some of which may serve to counterbalance or mute the effects of a potential recession on the promo field.

These include:

- 2022's strong overall economy

- Marketing budgets stockpiled during the pandemic

- The popularity of in-person events

- The promo market's shift from quantity to quality

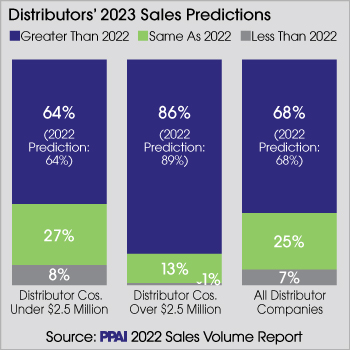

The industry may also move through the recession propelled by its heady momentum. The SVE, completed in January, found that 93% of distributors surveyed expected to meet or exceed 2022's revenues in 2023.

“It’s Weird”

It’s possible the U.S. is looking at a “jobs-full” recession. The labor market may experience some weakening. The unemployment rate is expected to rise to 4.5%, equating to the loss of about 900,000 jobs. This, however, would still constitute a tight labor market.

Existing labor shortages should blunt the recession’s impact on the labor market. Baby Boomers’ retirement and effects of the pandemic are conspiring to shrink the working age population and suppress labor force participation.

- In 1980 there were approximately 4.2 working-age persons (ages 25-64) to retired persons (ages 65 and above); in 2023, the number of working-age persons to retirees has shrunk to less than three.

“Millions of people are leaving the job market,” says Dana Peterson, the Conference Board’s chief economist. “There are the Baby Boomers, immigration policies are tight and the pandemic has kept people out of the labor market. Many parents aren’t working right now because they can’t find childcare. And because of the labor shortages, people are comfortable quitting. People who quit see their incomes rise faster.

“It’s different, it’s weird. And the real difference is something tangible, and that’s the labor shortages.”

Inflation

Inflation remains a big deal. For a good five quarters, growth in real wages has been negative. And while the tight labor market has pushed up wages, wage growth still trails inflation. A key driver of the economy’s move into recession, The Conference Board notes, is the Federal Reserve Board’s move to tighten interest rates in response to inflation.

- The Conference Board anticipates two or three more interest rate hikes of 25 basis points over the course of 2023, with cuts unlikely until early 2024.

What else is driving inflation? Analysts at The Conference Board cite housing costs and a strong demand for services post-pandemic as some of the most significant factors. Consumers’ appetite for services has come at the expense of the manufacturing sector.

“It hasn’t been rosy,” says Peterson. “The data has shown contraction for months. This is driven by consumer spending. During the pandemic spending shifted to goods, now it’s going from goods to services. Not good for manufacturers.

“Looking ahead, we expect to demand to continue to soften and actually contract, and we expect that to impact goods more than services.”

Inflation rates are forecast to decelerate over the course of 2023 and 2024, with the Fed’s 2% target not likely reached until the end of 2024. Home price valuations have peaked and are slowing. Rents are also lower than during the pandemic. These trends bode well for consumer inflation gauges ahead.

However, several factors could spark further inflation. These include:

- Sticky food prices, driven by the war in Ukraine, and flooding, droughts and disease outbreaks.

- A return to elevated energy prices, fueled by a reopening China increasing its consumption of services and energy. A spike in Chinese oil demand may raise prices and therefore inflation globally.

- Continued consumer spending is also a risk. Consumer spending slowed in November and December, but a warmer-than-expected January stoked consumption that month. Whether it lasts depends on consumers’ saving levels, wages and credit.

- Labor shortages may also further drive inflation, as they remain acute in certain sectors. Workforce shortages put pressure on wages and therefore inflation.