Trendline: 'Tis Better To Give

According to a recent study conducted by Coresight Research, corporate gifting has swelled to previously unrealized levels since the onset of the pandemic in early 2020.

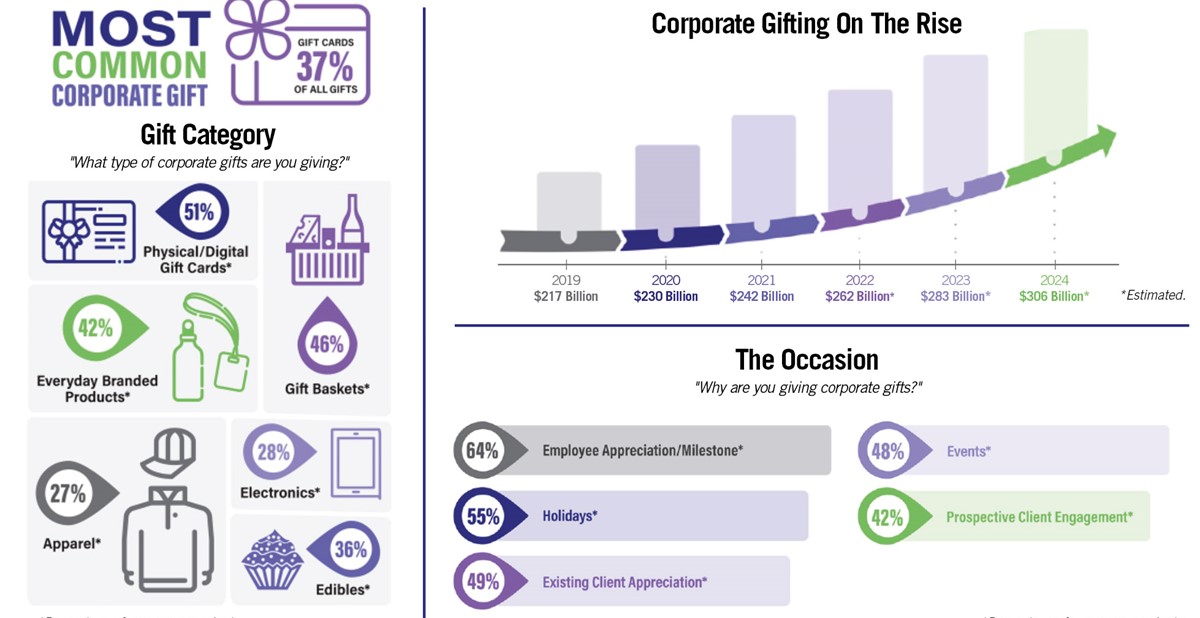

A 2018 estimate placed the market at $125 billion, but the newer study finds it to be far more robust, an estimated $242 billion in 2021, and likely to swell to over $300 billion by 2024.

Naturally, promotional products distributors and suppliers specializing in corporate gifts are excited to hear the updated estimates, and say the new numbers are reflective of the uptick in business they’ve experienced since many office workers began to perform their duties remotely starting in the initial quarantine period, leaving their employers seeking ways to keep them feeling engaged and appreciated.

“During COVID, companies were trying to stay connected with staff,” says Pat Barry, executive vice president of sales at Austin, Texas-based distributor Boundless. “That has continued with a greater emphasis as companies are now are looking to retain staff and attract new employees due to record low unemployment.”

The new estimate comes from a survey of 300 corporate gift buyers across companies up to $30 billion in revenues. “The first thing we set out to do was determine the actual size of the corporate gifting market,” Kevin Payne, vice president of corporate marketing at study sponsor GiftNow, told Forbes. “We felt it was bigger than previous estimates, but how much bigger we didn’t know. We also believed it grew extremely fast over the past year and the study confirmed it. Corporate gifting is growing faster than the rest of the gifting market.”

The study was conducted in May and released in June. It includes ample information relevant across the entire promo industry, including gifting trends and key data on the purposes of corporate gifts and the types of gifts most frequently sought.

Distributors say the remote work trend and rising transience in the workforce have increased the importance of gifts being particularly thoughtful, rather than compulsory or routine.

“Overall, our clients are using moments to unleash the power of human connection and deepen their relationships, which in turn increases retention,” says Hillary Feder, MAS, president of Hopkins, Minnesota-based distributor Hillary’s. “Two years ago, people just wanted to get something into their employees’ or clients’ hands to say ‘I am thinking of you.’ Today, we are working more strategically with them to step back and look at the big picture.”

Both Boundless and Hillary’s won PPAI Pyramid Awards for exceptional gifting programs in 2021.

“A thoughtful corporate gift includes knowing where people are, where their heads are at, what is keeping them up at night,” Feder says. “There is a ‘thinking investment’ to land on the right products. You need to know your client, their company brand, values, culture and voice. Know who will be the recipients—it is not one-size-fits-all, even in bulk gifting. It might mean a couple of different options if you are going to implement authentically and with heart.”

As for the specific items corporate gifters are looking for, gift cards—both physical and digital—lead the way, making up 37% of all gifts, with 51% of study participants including gift cards in their programs. Everyday branded products, gift baskets, edibles and apparel still represent large segments of the marketplace, but electronics and elevated branded merchandise are on trend. Barry says clients are looking for “brands, brands, brands.”

“There has been a pivot to perceived value,” he says. “Nobody wants to be perceived as cheap.”

Peter Hirsch, MAS, president of Houston-based supplier Hirsch Gift, says buyers are increasingly looking for the “it factor,” and cites Amazon best-sellers and Oprah’s Favorite Things list as guides for particular items that are trending.

“Retail top brands have a higher perceived value than a generic product that may be similar,” Hirsch says. “A generic speaker, for example, may appear similar to a JBL speaker, but the JBL speaker is backed by a research and development department of 250 engineers. That difference will be picked up by the discerning ear, but perhaps more importantly, the recipient is receiving a branded product that they have faith in and know is backed by a retail warranty.”

Hirsch says that a major factor in the increase in corporate gifting spending comes from organizations cutting back their in-person events and instead using those marketing dollars on promotional products.

To project for 2021-2024, Coresight Research landed on a compound annual growth rate (CAGR) of 8.1%. For comparison, the wCAGR for personal gifts is expected to be 6% during the same time frame.

Josh Ellis is the publisher and editor-in-chief at PPAI.