From Ordinary To Extraordinary: The Year Of The Large Distributor

2015 PPAI Distributor Sales Volume Report

For the first time, large company sales revenues made the difference between a flat year and a record-breaking one—at nearly $21 billion.

It was the best of times for some, it was the worst of times for others. Then again, maybe that’s too extreme on both ends of the spectrum. While there were both huge gains and lackluster sales among industry companies in 2015, in general it was a year of average positive growth for promotional product distributors. It was also a year in which the gap between small and large distributors widened enough to change the balance between both groups in the total sales volume figures for the industry. Overall, 2015 was the year of the large distributor.

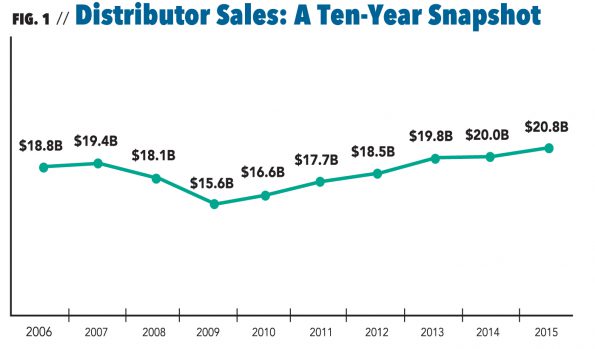

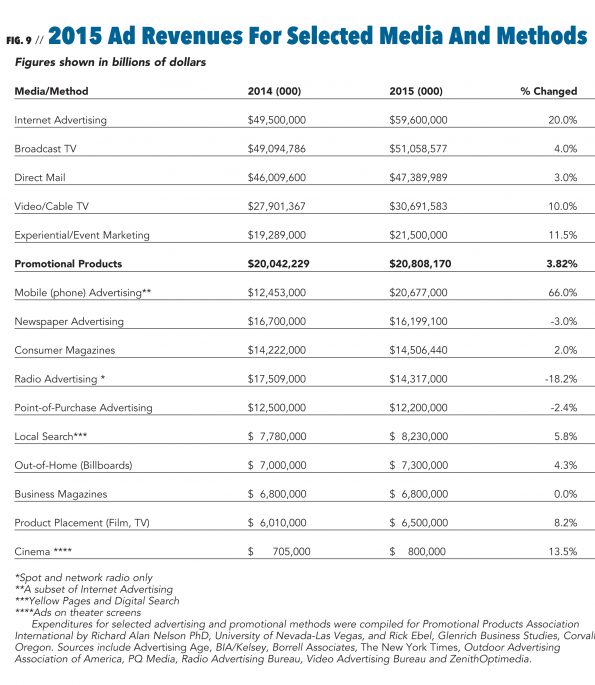

Total industry sales by distributors increased by 3.82 percent to nearly $21 billion ($20,808,170,722)—breaking the record set in 2014.

While sales continued the upward trend started in 2009, the net positive result is due solely to a significant increase in revenue among large distributor companies. In contrast, small distributors’ revenue declined further compared to 2014. Small distributors, those with sales of less than $2.5 million, experienced a 6.63-percent decline over 2014, while larger companies saw a 14.05-percent increase.

The other big news in 2015 is that promotional products’ percentage of growth was greater than any other traditional advertising media (see chart below), except for broadcast TV at four percent and billboards at 4.3 percent. With a growth rate of 3.82 percent over 2014 sales, promotional products beat out direct mail at three percent growth, consumer magazines at two percent, business magazines, which were flat, and radio, which plummeted by 18.2 percent. However, it’s interesting to note that print advertising shows signs of stabilizing with business magazines remaining steady year over year, consumer magazine revenue actually growing last year and newspapers down only three percent compared to -3.5 percent in 2014.

“The results of the 2015 Annual Distributor Sales Report reflect year-over-year growth for the promotional products industry in a relatively flat year for non-digital advertising in general,” says Paul Bellantone, CAE, president and CEO of PPAI. “Our growth speaks to the power and effectiveness of promotional products as a stand-alone marketing tool as well as part of integrated campaigns where building strong customer relationships is key. While many of our larger distributor respondents fared best with significant double-digit growth, segments of the small distributor community were flat and down year over year. I think these results are reflective of the investments companies will continue to make to deliver an omni-channel approach to serving the marketplace. Overall, I am pleased to see our industry continue to show its strength and value in an uncertain economy.”

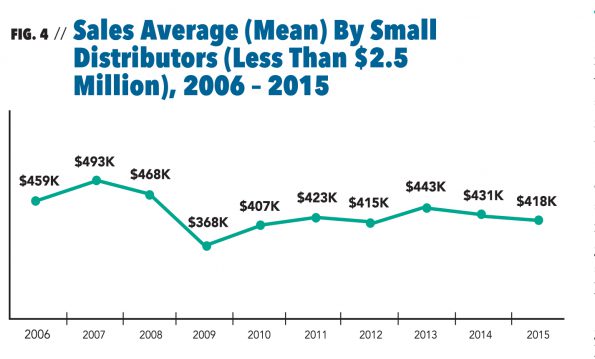

The prediction in recent years that large companies would keep getting bigger and small companies would decline gained more of a toehold in 2015. The overall number of companies with sales less than $2.5 million that report promotional products sales declined to 22,153 from 23,025 in 2014. However, the number of large companies with sales of more than $2.5 million reporting sales remained relatively stable at 868 compared to 872 in 2014. In addition, the total number of U.S. distributor companies reporting sales in 2015 was 23,021, slightly down from 23,896 in 2014.

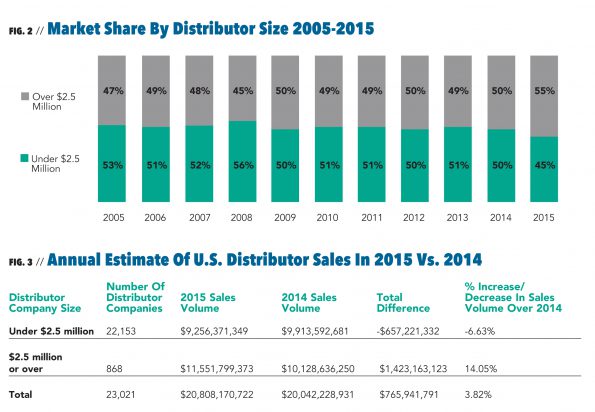

In terms of market share, the 868 firms representing large companies (sales of $2.5 million or more) captured $11,551,799,373 of the business—a 55.5-percent share. It should be noted that the large-company grouping included franchisors like Adventures in Advertising, Proforma and iPROMOTEu, and these firms report for their franchisees. Sales for the smaller distributors as a group amounted to $9,256,371,349, or 44.5 percent.

For the first time in many years, large distributors accounted for a larger proportion of the total sales volume than smaller firms, carving out five additional percentage points of the total sales performance.

As in 2014, only large companies had positive results by year-end. Distributors in the $2.5 million-plus bracket recorded sales of $11.5 billion, showing significant gains at a 14.05 percent increase over 2014. On the contrary, the smaller-company segment saw a greater decline of -6.63 percent, with total orders of approximately $9.3 billion.

A look by sub-segment reveals that most of the small-company categories saw a decrease in sales in 2015. The only sub-segment that experienced positive growth included companies with sales of $500,000 to $1 million (16.07 percent). Companies with sales of more than $1 million to $2.5 million had the biggest decline in sales among all sub-segments at -20.50 percent.

What About Profits?

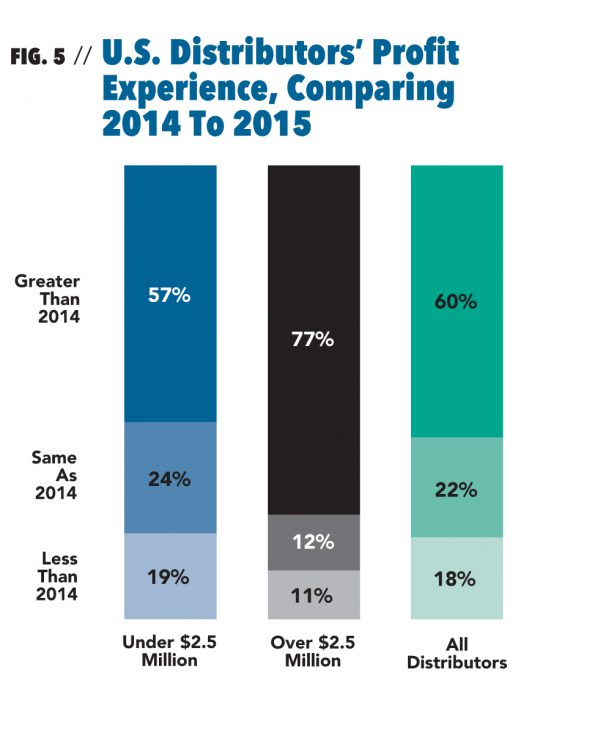

Much like 2014, nearly 60 percent (57 percent) of all distributors saw greater profits over the previous year, but large distributors saw the biggest wins in profits. In this group, 78 percent indicated they enjoyed higher profits in 2015, compared to 62 percent in 2014, while only 57 percent of the small distributors did so, remaining at the same level as 2014 (57 percent in 2014). One in five small distributors saw lower profit levels than in 2014, while a quarter experienced the same profit level.

The Continued Rise Of Online Sales

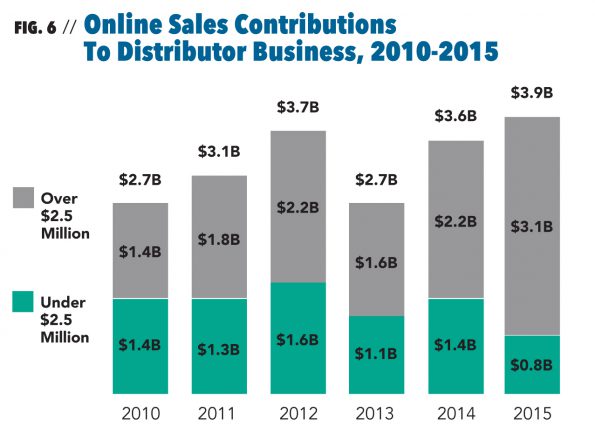

Online sales are defined as buys resulting from orders placed through an online store or website. Web sales (not to be confused with salespeople transmitting orders online) are estimated to be $3,944,881,904, or 19 percent of the industry total sales.

This category of promotional products sales continued to grow, representing 19 percent of the sales volume in 2015, up two percentage points from 17.9 percent in 2014. Total online sales grew by 10 percent over 2014 to $3,944,881,904, solely due to an increase in online sales among large distributors.

However, compared to 2014, the rate of growth in online sales slowed down significantly in 2015, mainly due to a significant decline in online sales by small distributors (-39.5 percent).

2015 Sales By Products And Programs

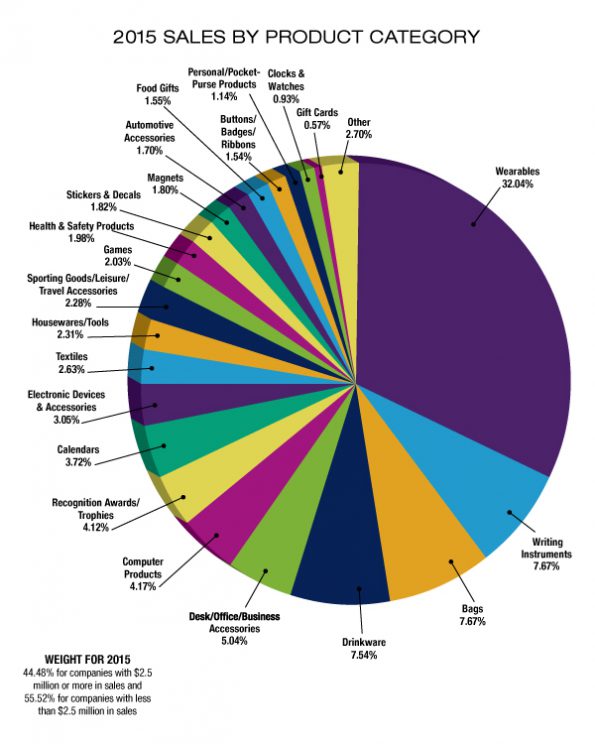

T-shirts, golf shirts, aprons, uniforms, caps, jackets, neckwear and footwear continued to be the biggest category of promotional products from a sales point of view with total wearables sales up again last year over 2014, capturing 32 percent of the market.

Historically, the second, third and fourth best-selling categories jockey for position every year with writing instruments and bags tying for the second spot with 7.67 percent of sales each in 2015, followed by drinkware at 7.54 percent, desk and office at five percent and the remaining product categories following at a strong pace.

In 2015, sales in almost every product category rose slightly with some of the biggest gains in desk and office products and sporting goods, leisure and travel accessories.

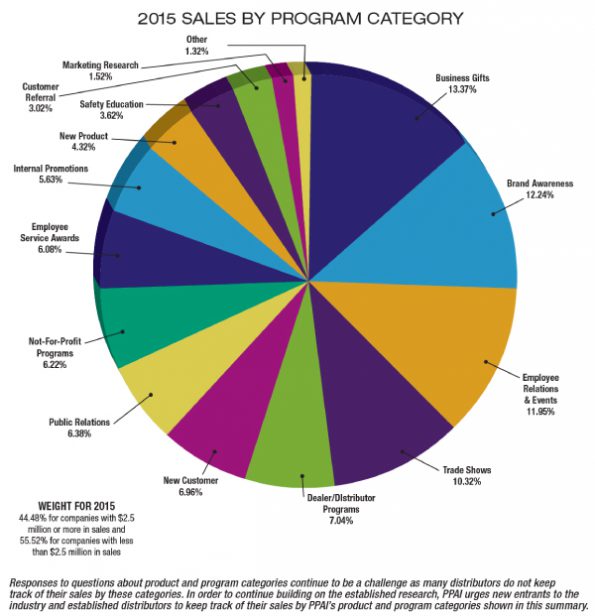

In sales by program category, the big winner in 2015 was business gifts at 13.37 percent followed by brand awareness at 12.24 percent, which held the lead in 2014 at 14.43 percent. Employee relations and events rose last year to 11.95 percent of sales, a 2.27-percent increase over 2014. In addition to business gifts, sales for public relations programs was the big gainer in 2015, rising from just under five percent to 6.38 percent.

Inside The Research

PPAI’s 2015 Annual Distributor Sales Summary resulted from an independent email/mail survey of industry distributors (including both PPAI members and nonmembers) conducted during March – April 2016, by Relevant Insights LLC, an independent market research firm. In addition, a census of the largest firms was also undertaken. Combining the samples from the different data collection methods used resulted in a total of 23,021 (22,153 small firms and 868 large firms) distributor surveys covering the entire U.S. industry. Responses projected across the entire distributor population combine sales for small distributors (under $2.5 million) and large distributor firms (over $2.5 million) to determine the total promotional products dollar volume.

The full report, containing 41 years of historical data, sales by company size and more predictions for 2016, is free to PPAI members at www.ppai.org. Click on Inside PPAI and then on Research.

Michaela Mora is principal of Relevant Insights, LLC. Tina Berres Filipski is editor of PPB.

Promotional Products Spend In 2015 Ranked Sixth Among All Media

By Richard Alan Nelson, Ph. D. and Rick Ebel

Although not a banner year for advertising revenue, in 2015 most media kept pace with what nowadays passes for inflation—but the digital platforms were booming.

Broadcast TV had a reasonably decent year with a four-percent gain (see table below), prompting CBS chief Leslie Moonves to crow and throw a dig at the rising digital opposition. “Everyone is now coming to the same conclusion that we came to a long time ago. Broadcast television remains the single best and most effective medium for advertising,” he claimed in an Advertising Age report. “Digital advertising sometimes lacks accuracy and credibility. As a result, there is a clear shift in advertising back to network television.”

But then, broadcast TV does have some special, crowd-pleasing assets working for it—like the Super Bowl. Back in 1978 you could buy a 30-second spot during the biggest game of the year for only $185,000. Well, those same 30 seconds at Super Bowl 50 earlier this year cost Anheuser-Busch a cool $5 million to convince viewers to try Michelob Ultra.

Sydney Ember, writing in The New York Times this spring, had an interesting take on digital advertising. Ember wrote: “The explosion of online ads, however, has led to the rising use of ad blockers and turned ‘advertising’ into something like a dirty word. So advertisers and publishers are now looking for ways to make online ads less like ads. Many in the industry are even changing the way they talk about ads.”

Seismic shifts in the media landscape have forced a sea change among media organizations resulting in mergers, and some organizations eliminating research departments and getting out of ad spend measurement entirely.

Some, like cable TV, an industry with modestly rising revenues, have merged with video. The decline in point-of-purchase business has eliminated the standalone trade group POPAI and created a merged group—A.R.E./POPAI, a new association dedicated to enhancing the total shopper experience. And you may have noticed skinnier Yellow Pages directories lately, if you use them at all. Reading the writing on the wall, the old Yellow Pages publishers’ group paired itself with digital to become a new entity, Local Search, and revenues are up almost six percent.

This year’s total ad spend is expected to rise, thanks to the summer Olympics and the U.S. presidential election, forecasts London-based ZenithOptimedia, and just about everyone else in that business. With electioneering requiring a lot of yard signs and bumper stickers, look for the presidential election to add $11.4 billion to 2016 ad revenues, predicts Virginia-based media consultant Borrell Associates. That’s 20 percent more than in the 2012 presidential race. Borrell reports that nearly half of the 2016 political dollars—$5.5 billion—will be spent on local and state elections. That can buy a lot of hot air.

Dr. Richard Nelson, RnelsonLV@gmail.com, is adjunct professor of integrated marketing communications at the Hank Greenspun School of Journalism and Media Studies at the University of Nevada-Las Vegas. Rick Ebel, glenrichbiz@gmail.com, is the former PPAI marketing communications director and now principal of Glenrich Business Studies, a business writing and research firm in Corvallis, Oregon.

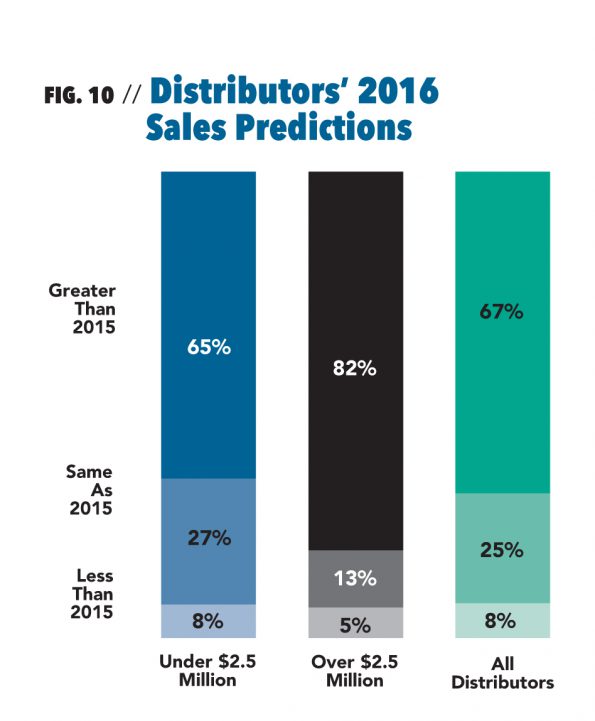

How’s Business In 2016? Most Distributors Anticipate Finishing Strong

Although many distributors are optimistic about their company’s growth in 2016, there are fewer who expect increased profit margins (62 percent) in 2016 compared to the expectations for 2015 (66 percent), especially among small distributors. Fewer in this group have a positive outlook regarding sales (65 percent) or profit (60 percent) for 2016 in comparison to 2015 (68 percent and 65 percent, respectively). The downturn in the oil and gas industry is expected to continue having a negative impact on many distributors, particularly in Texas.

Howeer, companies that participated in the 2015 survey remain optimistic both about sales and profits for 2016, especially large distributors. More than three-quarters of large distributors feel confident about their sales (85 percent) and profit (76 percent) forecast for 2016.

Although, historically, large distributors are more likely to predict higher sales and profits for the upcoming year than smaller companies, there are significantly more large distributors who predict higher sales and profit margins for 2016 compared to their predictions for 2015, while smaller firms’ predictions remain relatively unchanged.

PPB spoke with the principals at eight small, mid-sized and large distributor companies to see what they are expecting economically for 2016 and to ask about the challenges and concerns that are keeping them up at night.

Anita Emoff

Anita Emoff

CEO and Majority Owner

Shumsky/Boost Rewards (UPIC: SHUMSKY)

Dayton, Ohio

Company: Shumsky was founded in 1953 by Hy and Elsie Shumsky, grandparents of owner Michael Emoff. In 1984, Michael and his mother, Jayne Miller, took over the company. Since then Shumsky has expanded into brand verticals including recognition (Boost Rewards) and medical recovery pillows (Shumsky Therapeutic Pillows). Anita joined the company in 2006 and in 2009 became president of Boost Rewards. In 2013, Boost and Shumsky were merged into one entity with Anita named CEO and majority owner of the Shumsky and Boost brands. The combined companies continue to grow with a focus on differentiation (including traditional and custom promotional products, promotional e-commerce, fulfillment and point-of-sale) to define their space in the market verticals they serve, which includes technology, healthcare, automotive/transportation and retail/consumer packaged goods.

Economic Outlook: “Our bookings are up 16 percent YTD and our billings are up seven percent,” says Emoff. “We expect to end the year up around 10 percent. Our recognition solutions are growing faster than our promotional solutions, but we are driven by more larger opportunities in promotional, which could spike us up quickly over recognition. We experienced a similar situation last year with recognition growing faster.”

Biggest Concerns: “Our biggest concerns for promotional are safety and compliance demands from our larger clients. We must adapt our supply chain to match this demand and [we] find it challenging.”

Marc Katz

Marc Katz

CEO

CustomInk (UPIC: C594384)

McLean, Virginia

Company: CustomInk was founded 16 years ago to help people design and order custom t-shirts online. Since then, CustomInk has grown to be a leader in custom apparel for groups and communities, and has helped its customers create more than 75 million custom shirts. It serves hundreds of thousands of schools, teams, clubs, charities and businesses large and small, in addition to families and friends for all sorts of special occasions. The company employs more than 1,600 people across multiple facilities nationwide. The company uses state-of-the-art screen printing, digital printing and embroidery for most of its production.

Economic Outlook: “We’ve had robust growth over the past few years, having tripled sales since 2012 to over $300,000, and we’ve continued to grow at a healthy pace this year, led by strong customer loyalty and strength in the business category, one of our fastest-growing segments. As a private company, we don’t provide financial forecasts, but we expect to continue growing our historical business, while also expanding newer business lines, such as Booster, a grassroots fundraising platform that helps raise awareness and money for charity through custom apparel sales, and Pear, a sponsorship platform that helps connect brands with national and local groups to fund their custom gear and other needs. This April, we completed the acquisition of Represent, a Los Angeles-based social commerce startup that helps celebrity influencers like actors, athletes, musicians and thought leaders create and sell limited-run t-shirts and merchandise to their supporters.

Biggest Concerns: “This is such a dynamic market with lots of opportunity, so our biggest challenge is generally prioritization and execution. This is particularly true online, where mobile and social trends have fundamentally changed what’s possible, while also upping the ante for what it takes to succeed.”

Bob Lilly, Jr.

Bob Lilly, Jr.

CEO/President

Bob Lilly Promotions, LLC.

(UPIC: BOBL8430)

Dallas, Texas

Company: Bob Lilly Promotions is an industry-leading integrated marketing solutions agency with offices in Dallas, Houston and San Antonio, Texas. It offers customers solutions for promotional products, awards and apparel as well as distribution, fulfillment, printing, packaging, creative design and technology platforms to support program sales.

Economic Outlook: Lilly reports the company is down Q1 year over year by 10 percent but Q2 is slightly up year over year by five percent. “Our pipeline has improved due to new business onboarding as well as higher oil prices. We should finish flat to slightly up YOY,” he says.

Biggest Concerns: “We are focused on creating a company that attracts young, talented people. We recognize the buyers are getting younger and their needs are changing. We want to remain relevant in the way we think about and serve the needs of our customers.”

Jeff Becker

Jeff Becker

President

Kotis Design

(UPIC: kotis752)

Seattle, Washington

Company: Jeff Becker began selling t-shirts to fraternities and sororities at the University of Washington in 2003. After graduation, many of the same reasons students bought from him applied to the corporate world. Since then, the company has brought decoration in house, opened two distribution centers, greatly expanded its technology and now sells to clients across the country. Key markets served include college, beverage and corporate, with services including in-house decoration, warehouse and fulfillment, web platforms and talents of a full creative team.

Economic Outlook: “2016 started strong, but we have seen a slow down since the middle of Q1. Clients are being cautious and conservative with their spending, much of which I’d attribute to their uncertainty in the market (election, retails sales down, gas prices low, international unrest, etc.). We have averaged over 30-percent growth since our inception, and even though sales will definitely be up compared to 2015, we may not hit that 30-percent mark.”

Biggest Concerns: “The biggest concern I have right now is what our economy has in store for us. I see the average American spending less (i.e.: general retail sales down, not upgrading to the new iPhone, spending a higher percentage of wages on rent, etc.). The loss, tightening or delay of budgets may be out of our control. However, if we do our jobs effectively, we should be able to show our clients that the use promotional products will drive sales to combat the decrease. We’ll just have to fight more and get better in all aspects of our business.”

Brian Grall

Brian Grall

General Manager

LogoMyBiz.com

(UPIC: LogoMy)

Evergreen, Colorado

Company: Just launched in 2015 in Oregon and relocated to Colorado this year, it serves mostly small-business clients, with a smattering of corporate America, as well as entities in the beverage industry, education/government and nonprofits.

Economic Outlook: “Year-over-year growth is good, but is ‘good’ ever enough? We have added a few account executives so far this year with intentions to carefully add more by the end of the year. While never content, our outlook for the long term remains enthusiastic.”

Biggest Concerns: “Big-picture-wise, staying relevant in a consolidating industry is our biggest challenge. We are racing against the industry consolidation clock to make sure LogoMyBiz.com becomes established as a relevant long-term player. On a more local basis, the commercial real estate market is a challenge presently, delaying our preference for investment property for an office/conference/showroom. Otherwise it is the typical startup—juggling many balls while developing sales.”

Tim Hennessy, Sr.

Tim Hennessy, Sr.

President

Concepts & Associates

(UPIC: 6971)

Birmingham, Alabama

Company: The 33-year-old company was built on service with an outstanding group of employees, and offers a full range of products and brands, online company store programs, an embroidery operation and global sourcing. It serves markets in the U.S., Canada, Mexico and Europe.

Economic Outlook: Hennessy reports the company is doing well, having had its best year ever in 2015. “We expect a moderate gain in 2016, but with some good luck and fortune, Concepts again could end having our best year ever. There are a number of projects we’ve worked on for a while that came to fruition and we are picking up speed on some things we’ve invested in. You pay your dues and hopefully you get something out of it.” He’s also noticed that the spend level has come back in our industry. “It’s not yet to the ’07 or ’08 level yet but people seem to have some money and they realize they need to spend it to take care of their people. They are doing more with less and have to reward their people and clients. Client retention is paramount—it’s the lifeblood of a company.”

Biggest Concerns: He notes two key areas: Online offering of products from companies outside our industry and the ease of entry into the promotional products industry.

Stephanie Zafarana

Stephanie Zafarana

President

Pica Marketing Group

(UPIC: ezgreen)

Dearborn, Michigan

Company: PMG was established in 2008 during the depths of the recession. During those years of tight budgets, Zafarana noticed a profound need to help marketing executives track and report their ROI and ROO. Services offered today include employee incentive programs, safety programs, company stores, fundraising programs, direct mail and packaging. Key markets served are healthcare, not-for-profit, technology and retail.

Economic Outlook: “As of April 30, we’re up just about 50 percent in gross sales with our average order size up 38 percent. We are not anticipating a slowdown in our business from its current trajectory.”

Biggest Concerns: “Our most difficult challenge right now is growing our business smartly. We are struggling with the idea of hiring a person to help with the administration, research, quotes and orders. Two of our biggest concerns are the sustainability of the role and do we have enough work to fill a fulltime employee? More importantly, [how do we] not sacrifice the client experience as we scale the business. Therefore, in the short run, we are using new technologies to help manage some of the processes and follow up.”

Joe Walkup

Joe Walkup

President

Innovative Business Products, LLC

(UPIC: ibp459)

Nashville, Tennessee

Company: Founded as a print company in 2004, it has expanded offerings to provide promotional products, apparel, warehousing, fulfillment and online storefronts to clients in the banking, healthcare and transportation industries.

Economic Outlook: “We are currently up for 2016. Our business has been up for the past three years and I don’t see it slowing down. IBP is in a growth mode right now. We are looking at new sales reps along with potential acquisitions.”

Biggest Concerns: “I think that consolidation is changing the industry. For the most part I think it is good, but it can make it challenging in other ways. That being said I am looking at doing the same thing.”