Brand Visibility Financial Institutions Can Bank On

The U.S. is home to more than 4,000 banks, according to the Federal Deposit Insurance Corporation – more than anywhere else in the world. With so many banks, from the local neighborhood branch to banks without any physical presence at all, consumers have a rich array of choices.

What makes people choose one bank over another? Robust account features and convenient access matter, but people also want to know they’re more than just another account. Research from BankBound shows that 47% of people select local banks over bigger national banks for more personalized service, and 59% prefer local banks due to better customer service overall.

Many small business owners also prefer small banks, citing an 81% satisfaction score with community banks compared to 68% for large banks.

Bigger, national financial institutions offer their own set of perks, too, from a recognizable name to a long history. For many consumers, this amounts to safety and trust.

Almost half of respondents in a Forbes Advisor survey said they would be willing to pay higher fees for accounts at more established banks. These banks might also offer relationship bonuses, like waived account fees or discounted loan rates. Promos can be another perk, with different branded items given to customers with various account types.

Whether people are banking with small or large banks, most are happy with the services they receive. A poll from the American Bankers Association reveals that 84% of Americans are happy with their bank, and 94% say their bank provides “excellent,” “very good” or “good” customer service.

However, just because bank customers are happy doesn’t mean they’ll necessarily stick around. Data from research firm Morning Consult shows that 8%-10% of customers open and close accounts every month.

Promotional products can help banks delight their current customers while attracting new ones. When all else is equal – like lower lending rates or access to mobile apps – consumers tend to bank with brands they know over ones they don’t. In fact, there’s a 21% greater chance that a better brand will sway a consumer’s decision when choosing a bank, according to research from IBM.

From brick-and-mortar banks to online-only banks, financial institutions of all kinds can capitalize on the power of promo to build visibility and fortify relationships.

What Do People Look For In A Bank?

When choosing a bank, consumers look for:

- Customer service/friendliness (54%)

- Convenience (51%)

- Fewer fees or no fees (51%)

- Brick-and-mortar location (42%)

- ATM network (32%)

- Interest rates (32%)

- Brand reputation (28%)

When it comes to online-only banks, there’s a trust problem. More than half of Americans say they have low trust in online banks compared to traditional banking institutions. To build trust and bring in new customers, banks should focus on authentic marketing. For example, financial institutions could engage in real conversations on social media and build further engagement with promo.

Address Financial Uncertainties

More than half of Americans (58%) felt confident about their financial position at the start of 2024. They have 10-15% more in their bank accounts now than in 2019, according to a JPMorgan Chase Institute analysis of the accounts of nearly 9 million Chase customers.

However, some don’t feel so optimistic. A nationwide survey by insights and marketing company Sales Fuel found that 35% of respondents believe they’ll never make or save enough money to accomplish their goals.

Banks and financial institutions can address these concerns through offerings like workshops at bank branches or tips and tutorials on banking apps. Another idea? Incentivize consistent saving with reward programs and celebrate savings milestones with promo giveaways.

Make It Personal

Personalization is a big opportunity in the banking and financial space. Consumers increasingly want banks to provide the kinds of experiences they get in other domains, and banks are delivering in innovative ways. For example, Northwestern Mutual designed a matchmaking algorithm much like a dating app. However, instead of finding potential love interests, it matches customers with financial advisers who can best help them.

Capital One is another example of banks delivering hyper-personalized experiences. Last year, the financial company touted cardholder access to presale tickets for a popular concert. As a result, hundreds of fans took to social media to share their plans for applying for a Capital One card.

Consumers want personalized offers and tailored experiences, and there’s nothing like promo to add that personal touch.

A Focus On Purpose-Driven Banking

The banking world is becoming more purpose-driven, focusing not just on profits but on working toward the greater good. In the SAS report, “Banking in 2035: Global Banking Survey Report,” 91% of C-level executives agree that financial services organizations can pursue profit and better society at the same time. About 3 in 4 also believe that banks are obligated to be socially responsible. Promo can play a part in many ways, from educating customers about environmental, social and governance initiatives to using promos that reinforce a commitment to ESG principles.

A Closer Look At Community Banking

Regional banks have grown about 50% between 2000 and 2020, while community banks have declined by nearly half over the same time period. Some of the reasons include higher regulatory costs and mergers and acquisitions.

While community banks may not be able to compete at some levels with large banks, they can embrace their role in the community and show citizens how they’re unique in their approach to customer service. Whether it’s welcoming customers to the lobby with fresh coffee and promo tumblers or sponsoring local sports teams with custom T-shirts, these banks can use promo in creative ways to connect with community members.

What Matters Most In Mobile Banking

When U.S. consumers click on their bank’s mobile app, they expect to be able to (in order of importance):

- View account transactions

- Cancel a lost or stolen card

- View account balance

- Access digital account documentation

- Suspend or block debit or ATM transactions

Mobile banking is so important, in fact, that 38% of Americans say it’s nearly as important as having a car, and 20% say it’s more important than having a dishwasher. Financial institutions can use promo to show customers how they can get the most from their mobile banking experience.

Educate With Promo

Nearly half of U.S. consumers (45%) use primarily mobile banking – especially millennials and Gen Zers. Among these population groups, 45% say they only bank digitally. And they don’t just want the convenience. More than half (59%) say they want digital banking services to include financial literacy tools and resources. Through promo campaigns, financial institutions can educate consumers on topics they want to hear about, from budgeting to investing.

Campaign Collateral

Sweeten the banking experience with the Domed Tin With Dollar Sign Mints. A bank’s brand gets seen every time someone reaches for – or shares – a mint.

NC Custom / PPAI 111662, S7

When someone opens a new account, thank them with the Infinity Series Gift Set. It includes a 20-ounce stainless-steel tumbler and a coaster inside a black or tan gift bag.

Moderne Glass / PPAI 112536, S10

Worn alone or paired with a blazer, the UNTUCKit Bella Long Sleeve Shirt provides a polished look for bank employees. This wrinkle-resistant shirt features slimming darts for a precise fit and buttons that prevent awkward gaps. Pick from black, white, frost blue and pink zircon.

PCNA / PPAI 113079, S15

Reward kids with a Building Block Bank when they open a savings account. It’ll build goodwill with parents and encourage kids to save. Available in clear, blue and white, banks can add an imprint on up to two sides.

Fields Manufacturing / PPAI 111951, S8

Whether used to incentive new customers or show appreciation to existing customers, the Bjørn Wireless 5000mAh MagSafe Power Bank makes a universally appealing gift. Complete with a USB charging cable, it keeps a bank’s brand visible with every power-up.

High Caliber Line / PPAI 205801, S10

Shine a light on special milestones for bank customers with the Stonewall Home Soy Blend Candle. Featuring hand-trimmed, lead-free wicks, each candle provides up to 50 hours of fragrance. Choose from five colors.

Gemline / PPAI 113948, S11

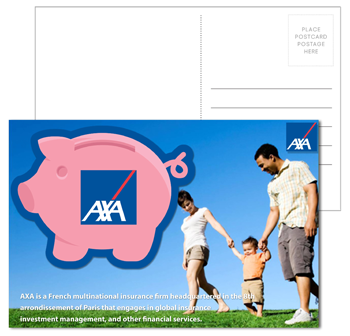

Promote credit card or loan offers with a Full-Color Postcard that includes a full-color reusable piggy bank coaster for maximum brand exposure.

Tekweld / PPAI 266346, S4